Federal Laws Regarding Wage Reduction

The Fair Labor Standards Act (FLSA) is the primary federal law governing wages and working conditions in the United States. Understanding its provisions regarding pay reductions is crucial for both employers and employees to avoid legal issues. This section will explore the FLSA’s stipulations on permissible and impermissible wage reductions, providing examples to clarify its application.

The Fair Labor Standards Act and Pay Reductions

The FLSA establishes minimum wage, overtime pay, and recordkeeping requirements affecting full-time and part-time workers in the private sector and in Federal, State, and local governments. While the FLSA doesn’t explicitly prohibit all pay reductions, it implicitly protects against reductions that violate the minimum wage or overtime pay requirements. Essentially, any reduction that brings an employee’s compensation below the legally mandated minimum wage or reduces overtime pay to below the legally mandated rate is unlawful. The Act focuses on ensuring employees receive fair compensation for their work, preventing employers from exploiting loopholes to circumvent these crucial protections.

Exceptions to the FLSA Regarding Permissible Wage Reductions

There are limited circumstances where a pay reduction might be legal under the FLSA. These exceptions generally revolve around changes in an employee’s responsibilities, hours worked, or performance. For example, a reduction in pay might be permissible if an employee voluntarily agrees to a reduction in hours or takes on a less demanding role with a corresponding decrease in pay. It’s crucial, however, that these changes are voluntary and clearly documented, with the employee fully understanding the implications of the pay reduction. The employer must also ensure that the reduced wage still meets the minimum wage requirements established by the FLSA.

Examples of Legal Wage Reductions Under the FLSA

A reduction in pay might be lawful if an employee transitions to a part-time position from a full-time position, with a corresponding decrease in pay reflecting the reduced hours worked. Another example could involve a demotion due to performance issues, provided the employee is properly notified and the new salary remains compliant with the FLSA’s minimum wage stipulations. Finally, a pay reduction could be acceptable if the employee agrees to a change in job duties that justifies a lower salary, again, provided the change is consensual and documented. In all cases, transparency and clear communication are key to avoiding legal disputes.

Examples of Illegal Wage Reductions Under the FLSA

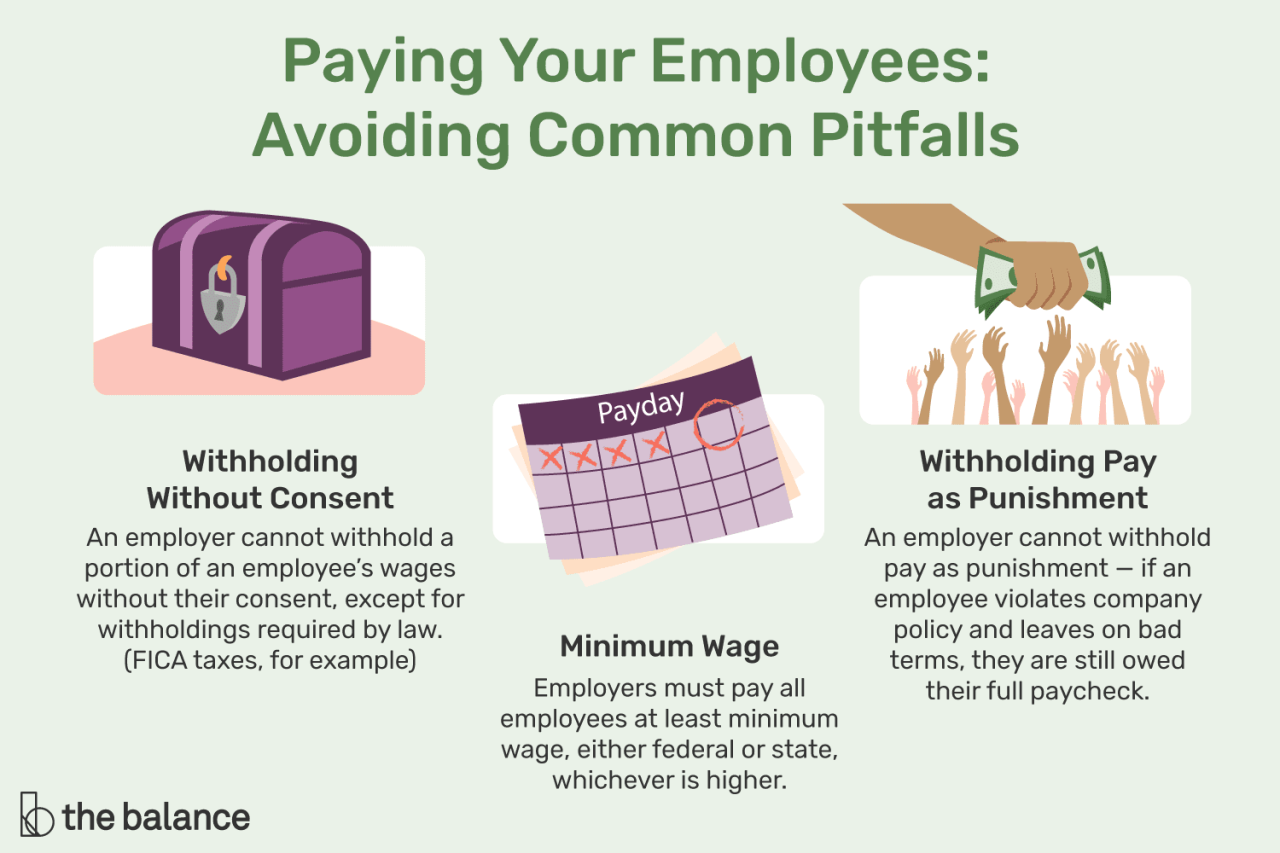

Retaliatory pay cuts are strictly prohibited. If an employer reduces an employee’s pay after the employee reports a workplace violation or files a complaint, it could be considered illegal retaliation under the FLSA and other federal and state laws. Similarly, reducing an employee’s pay without their knowledge or consent, or reducing pay below the legally mandated minimum wage or overtime pay, is clearly unlawful. Employers must always ensure they comply with all applicable federal, state, and local wage and hour laws. Unilateral changes to compensation without proper notification and agreement from the employee can lead to significant legal consequences.

Hypothetical Case Study: Legal and Illegal Pay Reduction

Scenario 1 (Legal): Sarah, a full-time employee, voluntarily requests a reduction in her hours from 40 to 20 per week due to personal circumstances. Her employer agrees, and her pay is reduced proportionally, ensuring she still earns at least minimum wage. This is a legal reduction as it’s voluntary and complies with minimum wage requirements. All changes are clearly documented in writing and signed by both Sarah and her employer.

Scenario 2 (Illegal): John, an employee, is unexpectedly informed that his salary has been reduced by 15% due to company restructuring. John is not given any opportunity to negotiate or discuss the reduction, and his new salary falls below the minimum wage required by the FLSA. This is an illegal reduction because it’s done unilaterally, without John’s consent, and violates the minimum wage requirement. John could potentially file a lawsuit against his employer to recover the lost wages and possibly additional damages.

State Laws and Wage Reduction

State laws governing wage reductions exhibit considerable variability compared to the relatively uniform standards set by federal law. While federal law provides a baseline of protection, individual states often enact more stringent regulations or offer additional employee safeguards. This variation stems from differing economic conditions, political priorities, and interpretations of employee rights within each state. Understanding these differences is crucial for both employers and employees to ensure compliance and protect their respective interests.

Variability of State Wage Reduction Laws

State laws regarding wage reductions differ significantly in several key areas. Some states have explicit laws prohibiting pay cuts without specific, justifiable reasons, while others offer less protection. The permissible reasons for wage reductions, the required notification periods, and the available remedies for unlawful pay cuts also vary widely. This creates a complex legal landscape where employers must navigate a patchwork of state-specific regulations to maintain compliance. Moreover, the definition of “wage” itself can differ across states, leading to further complications in determining what constitutes a permissible reduction.

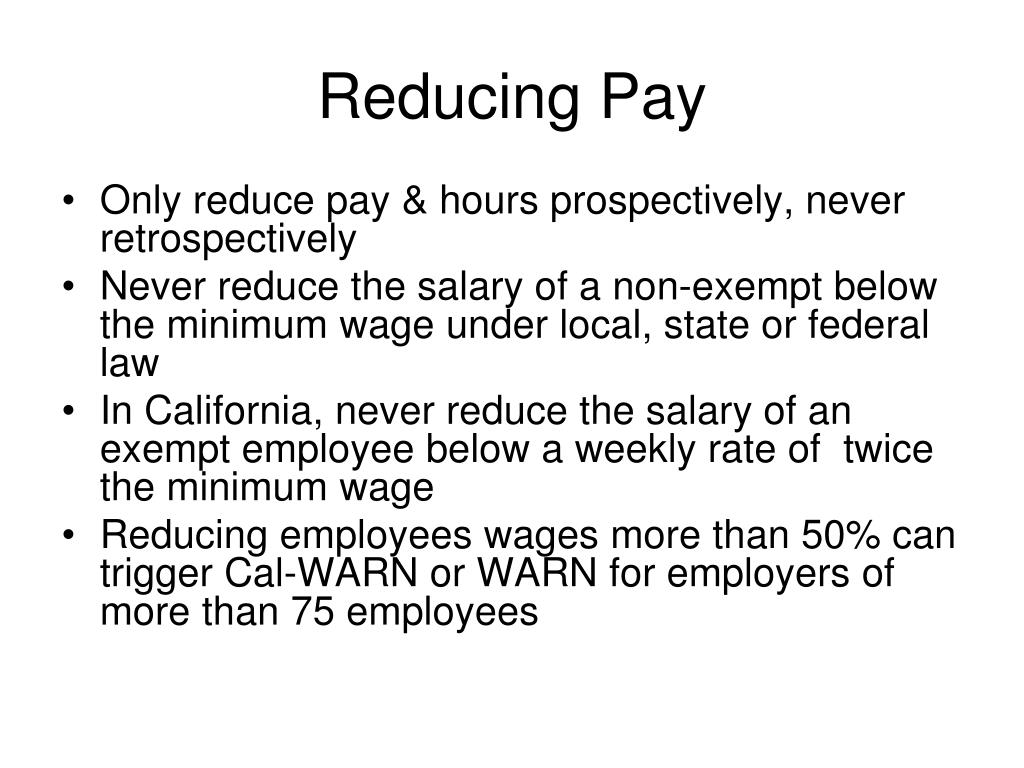

State-Specific Regulations: California, New York, and Texas

California, New York, and Texas offer illustrative examples of the diverse approaches states take to regulate wage reductions. California, known for its strong employee protections, generally prohibits unilateral wage reductions unless there is a demonstrable change in job duties or responsibilities. New York also provides significant employee protections, although its laws may be less prescriptive than California’s, leaving more room for interpretation in certain situations. In contrast, Texas generally affords employers greater latitude in adjusting employee wages, with fewer statutory restrictions on pay cuts. This difference reflects the varied economic and political climates of these states, highlighting the lack of a national, standardized approach.

Legal Protections in High-Wage vs. Low-Wage States

States with higher average wages, such as California and New York, tend to offer more robust legal protections to employees against arbitrary wage reductions. These protections often include stricter requirements for justification, longer notice periods, and more substantial remedies for violations. Conversely, states with lower average wages, such as Texas, may have less comprehensive regulations, potentially leaving employees more vulnerable to unilateral pay cuts. This disparity reflects a complex interplay of economic factors, political influence, and the relative bargaining power of employers and employees within each state’s unique labor market.

Interaction of State and Federal Laws

In cases where state and federal laws conflict, the Supremacy Clause of the U.S. Constitution dictates that federal law preempts conflicting state law. However, this principle doesn’t necessarily mean state laws are rendered completely irrelevant. If a state law offers greater protection to employees than federal law, that more protective state law will generally apply. For example, if a state mandates a longer notice period for wage reductions than required under federal law, the state’s longer period would control. Conversely, if a state law is less protective than federal law, the federal law would prevail. This necessitates a careful analysis of both state and federal regulations to determine the applicable legal standard in any given situation.

Comparison of Wage Reduction Laws Across Three States

| State | Prohibition of Unilateral Wage Reductions | Required Notice Period | Remedies for Unlawful Reductions |

|---|---|---|---|

| California | Generally prohibited without change in job duties | Varies depending on circumstances, often significant | Back pay, penalties, potential legal action |

| New York | Less explicit prohibition, greater emphasis on justifiable reasons | Less strictly defined than California | Back pay, potential legal action |

| Texas | Fewer restrictions, greater employer latitude | Minimal statutory requirements | Limited statutory remedies, primarily dependent on contract law |

Contractual Agreements and Pay: Is There A Law Against Reducing A Persons Pay

Employment contracts play a crucial role in determining the legality of pay reductions. While federal and state laws establish minimum wage standards and protections against arbitrary wage cuts, the specifics Artikeld in an individual’s employment agreement can significantly alter the landscape of permissible salary adjustments. Understanding these contractual provisions is vital for both employers and employees to avoid potential legal disputes.

Employment Contracts and Wage Reduction Clauses

Employment contracts can include clauses that explicitly permit or prohibit wage reductions under specific circumstances. A clause permitting reductions might stipulate that pay can be decreased in response to a documented reduction in work hours, a change in job responsibilities resulting in a lower pay grade, or a company-wide salary adjustment due to financial hardship. Conversely, a clause prohibiting reductions might guarantee a specific salary for a defined period, unless explicitly stated otherwise in the contract. For example, a contract might state, “Employee’s salary shall be $60,000 annually, subject to performance reviews and adjustments as Artikeld in Section 5,” or conversely, “Employee’s salary is guaranteed at $75,000 annually for the duration of this contract unless otherwise agreed upon in writing by both parties.” The specificity of the language is key to interpreting the permissibility of any pay decrease.

Implications of Breaching Contractual Salary Agreements

Breaching a contractual agreement regarding salary can have significant legal ramifications. If an employer reduces an employee’s pay in violation of a contractual guarantee, the employee may have grounds to sue for breach of contract. This could result in the employer being required to pay back the difference in wages, plus potential damages for emotional distress or lost opportunities. Conversely, if an employee accepts a pay reduction that was agreed upon in the contract, they generally cannot later claim that the reduction was illegal. The burden of proof in these situations rests largely on demonstrating the existence and terms of the contract, and whether the pay reduction adhered to those terms.

Legally Permissible Pay Reductions Based on Contractual Stipulations

Several scenarios allow for legal pay reductions based on specific contractual stipulations. These might include situations where an employee accepts a demotion with a corresponding pay decrease, agrees to a temporary pay cut during a period of company financial difficulty (with a clear agreement on the duration and terms of the reduction), or where the contract explicitly links pay to performance metrics and a pay reduction is a consequence of failing to meet agreed-upon targets. The key is that the pay reduction must be clearly Artikeld and agreed upon within the contract’s framework, and the employer must adhere to the procedures specified for such reductions. For instance, a contract might stipulate that failure to meet sales targets by a certain percentage will result in a 10% salary reduction for the following quarter.

Potential Legal Challenges Arising from Contractual Wage Disputes

Disagreements over contractual wage provisions can lead to various legal challenges. These may include lawsuits for breach of contract, claims of wrongful termination (if the pay reduction is used as a pretext for dismissal), and disputes over the interpretation of specific clauses within the contract. Additional complexities can arise if the contract is ambiguous or lacks clarity on the circumstances under which pay reductions are permissible. The outcome of such legal challenges often depends on the specific wording of the contract, the evidence presented by both parties, and the applicable laws of the jurisdiction.

Reductions Due to Performance or Misconduct

Reducing an employee’s pay due to performance issues or misconduct is a sensitive area with significant legal implications. Employers must tread carefully to avoid potential lawsuits and maintain a fair and consistent disciplinary process. This section details the legal considerations, best practices, and potential pitfalls associated with performance-based pay reductions.

Legal Considerations Surrounding Pay Reductions as a Disciplinary Measure

Pay reductions as disciplinary actions are generally permissible, but only under specific circumstances and with careful adherence to legal requirements. Federal and state laws, along with any collective bargaining agreements, significantly influence the legality of such actions. Key considerations include whether the reduction is consistent with the employee’s contract, whether the performance issues were clearly communicated and documented, and whether the disciplinary action is proportionate to the severity of the misconduct or performance deficiency. Failing to meet these criteria can lead to legal challenges and potential liability for the employer. For instance, an employer cannot unilaterally reduce an employee’s salary without a valid contractual basis or a clear violation of company policy.

Structuring a Fair and Legally Sound Performance Improvement Plan

A well-structured Performance Improvement Plan (PIP) is crucial when considering a pay reduction for performance issues. A fair PIP should clearly Artikel specific, measurable, achievable, relevant, and time-bound (SMART) goals. It should also detail the consequences of failing to meet these goals, which may include a pay reduction. Crucially, the employee should be given ample opportunity to improve their performance before any pay reduction is implemented. The PIP should be documented thoroughly, including dates, specific examples of performance deficiencies, and the employee’s acknowledgment of the plan. Regular meetings to review progress and provide support should also be documented. An example of a SMART goal might be: “Increase sales leads by 15% within the next quarter, as measured by the number of qualified leads entered into the CRM system.” The PIP should specify the consequences of not meeting this goal.

Potential Legal Pitfalls Employers Should Avoid, Is there a law against reducing a persons pay

Several pitfalls can invalidate a performance-based pay cut. These include failing to provide adequate notice and opportunity for improvement, implementing inconsistent disciplinary actions across employees, discriminating against protected classes (e.g., based on age, race, gender), and failing to properly document the entire process. Retaliation against an employee for reporting safety violations or engaging in protected activities is also a significant legal risk. Employers must ensure that the pay reduction is directly related to documented performance issues and not based on subjective opinions or biases. Furthermore, the employer should be prepared to demonstrate that the pay reduction is consistent with the company’s established policies and procedures.

Examples of Employee Misconduct Justifying and Not Justifying a Pay Reduction

Examples of misconduct that *might* justify a pay reduction (depending on company policy and severity) include consistent tardiness or absenteeism, repeated failure to meet deadlines, insubordination, and proven dishonesty. However, even in these cases, a progressive disciplinary approach is typically recommended, starting with warnings and opportunities for improvement before resorting to a pay reduction.

Examples of misconduct that would generally *not* justify a pay reduction include exercising legally protected rights (e.g., filing a workers’ compensation claim), reporting illegal activity within the company, or experiencing a documented medical emergency. These actions are typically protected under law and cannot be used as a basis for disciplinary action, including pay reductions.

Flowchart Illustrating Steps Before Implementing a Pay Reduction for Performance Issues

A flowchart depicting the process would visually represent the steps:

[Imagine a flowchart here. The flowchart would start with “Performance Issues Identified,” branching to “Documentation of Issues,” then “Verbal Warning,” followed by “Written Warning,” and then “Performance Improvement Plan (PIP) Implemented.” The PIP box would branch to “PIP Goals Met” (resulting in “No Pay Reduction”) and “PIP Goals Not Met” (leading to “Consider Pay Reduction”). The “Consider Pay Reduction” box would then branch to “Legal Review,” followed by “Pay Reduction Implemented” and “Employee Notification.” Finally, there’s a box for “Ongoing Monitoring and Support.”]

Reductions Due to Economic Hardship

Reducing employee pay due to economic hardship is a complex legal and ethical issue. While employers have a right to manage their businesses effectively, including making difficult financial decisions, they must do so within the bounds of the law and with a fair and transparent approach towards their employees. The permissibility of pay reductions hinges on several factors, including existing contracts, applicable state and federal laws, and the overall circumstances of the economic downturn.

Companies facing financial difficulties must carefully consider the legal implications before implementing pay cuts. Unilateral reductions, particularly without prior agreement or notice, can lead to significant legal challenges and damage employee morale and productivity. Open and honest communication is crucial to maintaining trust and minimizing potential conflict.

Legal Permissibility of Pay Reductions Due to Economic Hardship

The legal permissibility of reducing employee pay due to economic hardship varies depending on several factors. Existing employment contracts often dictate the terms of compensation, and unilaterally altering these terms without employee consent can lead to breach of contract claims. State and federal laws also play a crucial role, with some jurisdictions offering greater protections to employees than others. For instance, some states have specific regulations regarding minimum wage and overtime pay that cannot be circumvented even during economic downturns. Furthermore, the severity and duration of the economic hardship must be demonstrably real and impactful to the company’s financial viability. A simple downturn in profits might not justify widespread pay reductions, whereas a genuine threat of bankruptcy might be considered a more compelling circumstance. Legal counsel should be sought to assess the specific legal landscape applicable to the situation.

Importance of Transparent Communication During Economic Hardship

Maintaining open and transparent communication with employees is paramount during periods of economic hardship. When companies openly and honestly explain the financial challenges they face, employees are more likely to understand and accept necessary measures, even if those measures are difficult. This transparency fosters trust and reduces the likelihood of legal challenges or employee resentment. Effective communication strategies include regular updates, town hall meetings, and clear explanations of the company’s financial situation and the reasoning behind any proposed changes. This proactive approach helps to mitigate potential negative impacts on employee morale and productivity. Failing to communicate openly can create an atmosphere of suspicion and distrust, potentially leading to increased employee turnover and legal disputes.

Legal Strategies to Mitigate Financial Difficulties Without Widespread Pay Cuts

Several legal strategies can help companies navigate financial difficulties without resorting to widespread pay cuts. These include exploring options such as reducing operating costs, negotiating with suppliers, seeking government assistance programs, implementing hiring freezes, and reducing executive compensation. Restructuring debt, implementing temporary furloughs (with appropriate notice and potential benefits continuation), and exploring voluntary early retirement programs can also help alleviate financial strain without immediately impacting the pay of all employees. These approaches demonstrate a commitment to finding solutions that minimize the impact on employees while addressing the company’s financial challenges. For example, a company might temporarily freeze hiring for non-essential positions while exploring options for increasing efficiency and revenue.

Potential Legal Challenges from Mass Pay Reductions During Economic Downturns

Mass pay reductions during economic downturns can lead to several legal challenges. Employees may file lawsuits alleging breach of contract, violation of minimum wage laws, or unfair labor practices. Class-action lawsuits are also a possibility, particularly if a large number of employees are affected. The potential for legal challenges increases significantly if the company fails to provide adequate notice, follow proper procedures, or act in a fair and equitable manner. These legal challenges can be costly and time-consuming, further impacting the company’s financial stability. A strong legal defense requires careful documentation of the company’s financial situation, the rationale behind the pay reductions, and the steps taken to ensure fairness and compliance with all applicable laws.

Best Practices for Employers Navigating Pay Reductions Due to Economic Hardship

Before implementing any pay reductions, employers should:

- Consult with legal counsel to ensure compliance with all applicable laws and regulations.

- Conduct a thorough assessment of the company’s financial situation and explore all possible alternatives to pay reductions.

- Develop a clear and transparent communication plan to keep employees informed throughout the process.

- Treat all employees fairly and equitably, avoiding discriminatory practices in determining which employees will be affected.

- Provide adequate notice of any pay reductions, allowing employees sufficient time to adjust their budgets.

- Document all decisions and actions related to pay reductions to protect against potential legal challenges.

- Consider offering support to employees, such as financial counseling or job placement assistance.

Tim Redaksi