Introduction to Community Property Law and Contract Law: Does Community Property Law Supersede Contract

Community property law and contract law are distinct legal frameworks governing different aspects of property ownership and agreements. Understanding their fundamental principles and key differences is crucial for navigating legal issues related to assets and obligations. This section will provide an overview of each legal framework, highlighting their core tenets and contrasting their approaches.

Community Property Law Principles

Community property law dictates that assets acquired during a marriage belong equally to both spouses. This principle stems from the idea of a marital partnership, where both spouses contribute to the economic well-being of the family unit. The specific rules governing community property vary by jurisdiction, but generally, assets acquired after the marriage, excluding separate property brought into the marriage, are considered community property. This includes income earned, investments made, and property purchased during the marriage. Separate property, conversely, refers to assets owned by a spouse before the marriage, or received as a gift or inheritance during the marriage. The management and disposition of community property often require the consent of both spouses. Disputes regarding community property are typically resolved through legal proceedings, often involving property division in cases of divorce or separation.

Contract Law Tenets

Contract law centers on the enforcement of legally binding agreements between parties. A valid contract requires three essential elements: offer, acceptance, and consideration. An offer is a clear and definite proposal to enter into a contract. Acceptance signifies unequivocal agreement to the terms of the offer. Consideration represents the mutual exchange of value between the parties—something of legal value given or promised in exchange for a performance or promise. Capacity, or the legal ability to enter into a contract, is another critical element. Individuals lacking capacity, such as minors or those deemed mentally incompetent, may not be able to form legally binding contracts. Breach of contract, the failure to perform contractual obligations, can lead to legal remedies such as damages or specific performance.

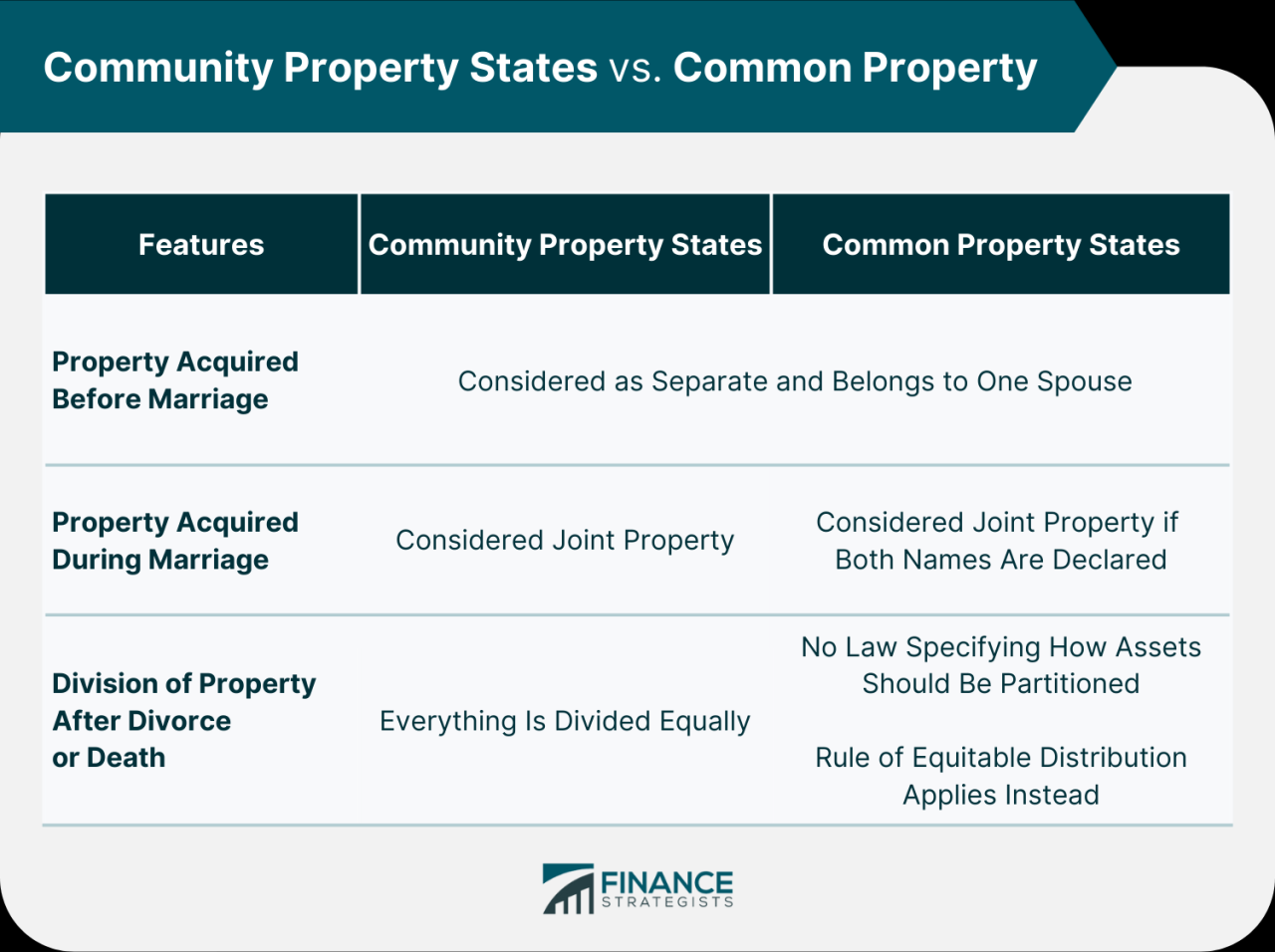

Comparison of Community Property and Contract Law

Community property law and contract law operate under fundamentally different principles. Community property law focuses on the automatic equal ownership of marital assets, irrespective of individual contributions or specific agreements. Contract law, conversely, emphasizes the voluntary agreement and exchange of value between parties. A contract, for example, might govern the division of assets in a divorce, but the underlying ownership of those assets is governed by community property principles. The existence of a pre-nuptial agreement, a contract entered into before marriage, might modify the default rules of community property law, illustrating the interaction between these two legal frameworks. However, the core tenets of each remain distinct: community property law emphasizes equal ownership based on marital status, while contract law emphasizes the voluntary exchange and agreement between individuals.

Debts and Liabilities in Community Property Regimes

Community property laws significantly impact how debts incurred during a marriage are handled and distributed upon separation or divorce. Understanding these rules is crucial for both spouses, as they determine financial responsibility and the division of assets. The fundamental principle is that community property, acquired during the marriage, is jointly owned, and community debts are jointly owed.

Community property rules generally dictate that debts incurred during the marriage for the benefit of the community are considered community debts. This includes expenses related to the household, raising children, or business ventures undertaken jointly. Conversely, debts incurred before the marriage or for the sole benefit of one spouse are typically classified as separate debts. The interaction between contracts and community property is complex, particularly when considering loan agreements.

Treatment of Debts Incurred During Marriage

Debts incurred during the marriage, such as mortgages on the family home, credit card debt used for household expenses, or loans taken out for business ventures operated jointly, are usually considered community debts. This means both spouses are jointly and severally liable for repayment. This joint liability extends to the division of assets upon separation or divorce; these debts must be addressed and often require repayment from the community property assets. For example, a mortgage on a jointly owned home would be considered a community debt, and the proceeds from the sale of that home would be used to pay off the mortgage before the remaining equity is divided. Similarly, credit card debt incurred for household expenses is usually classified as a community debt.

Contractual Obligations and Community Property

Loan agreements and other contracts entered into during the marriage directly influence the division of community property. If a loan is taken out for the benefit of the community (e.g., a home loan), the debt is considered a community debt, and the repayment responsibility rests on both spouses. The terms of the loan agreement, including interest rates and repayment schedules, are relevant in determining how the debt is handled during property division. However, if a spouse takes out a loan solely for their separate benefit (e.g., a loan for a personal investment unrelated to the community), that debt remains their separate liability. The terms of the contract are paramount in determining whether a debt is community or separate. Judges will often review the loan agreement to ascertain the intended purpose of the loan.

Separate Debts Versus Community Debts in Property Division

The distinction between separate and community debts is critical during property division. Separate debts are the sole responsibility of the spouse who incurred them. These debts are not typically paid from community property. For instance, a debt incurred before the marriage, or a personal loan used for a non-community purpose, would be considered a separate debt. Conversely, community debts are the shared responsibility of both spouses, and repayment usually involves the use of community property assets. The process of disentangling separate and community debts often requires careful accounting and documentation of all financial transactions during the marriage. This may involve examining bank statements, loan agreements, and other financial records to trace the source and purpose of each debt.

Business Interests and Community Property

When a business is considered a community asset—meaning it was acquired during the marriage—its inclusion in community property division requires careful consideration of any existing business contracts. These contracts can significantly impact the valuation and ultimate distribution of the business interest between spouses during divorce or separation. Understanding the interplay between business contracts and community property law is crucial for a fair and equitable outcome.

Does community property law supersede contract – A business contract, whether it’s a partnership agreement, loan agreement, or franchise agreement, can affect the value of the business and how it’s divided. For example, a contract that obligates the business to future payments could reduce its overall worth, while a lucrative contract could significantly increase its value. Furthermore, the terms of the contract might restrict the ability to sell or transfer the business, adding complexity to the division process. The court will examine all relevant contracts to determine the business’s fair market value and consider any contractual obligations impacting that value.

Impact of Business Contracts on Community Property Division

The impact of a business contract on community property division depends heavily on the specific terms of the contract and the nature of the business itself. A contract that significantly impacts the profitability or future potential of the business will undeniably affect its valuation and subsequent division. Conversely, a contract that has minimal impact on the business’s overall value might be less significant in the division process. The court’s role is to ensure a just and equitable distribution, taking into account all relevant factors, including contractual obligations.

Scenarios Illustrating Business Contracts and Community Property Division, Does community property law supersede contract

The following table illustrates different scenarios where business contracts influence the division of community property:

| Scenario | Contract Type | Impact on Business Value | Impact on Division |

|---|---|---|---|

| Business acquired during marriage, profitable long-term contract in place. | Long-term supply agreement | Increases business value significantly. | Higher valuation, likely resulting in a more substantial share for each spouse. |

| Business acquired during marriage, significant debt incurred through a loan agreement. | Business loan | Decreases business value due to outstanding debt. | Lower valuation, requiring debt consideration in the division process. Potential for one spouse to assume the debt. |

| Business acquired during marriage, restrictive covenant limiting sale for 5 years. | Franchise agreement | Potentially reduces immediate market value due to limited transferability. | Division might involve a valuation based on discounted future earnings or other creative solutions. |

| Business acquired during marriage, pending litigation due to a breached contract. | Sales contract | Uncertain impact on business value pending litigation outcome. | Division may be delayed until the litigation is resolved; valuation will reflect the potential outcomes of the litigation. |

Determining the Value and Distribution of a Business Interest

Determining the value and distribution of a business interest within a community property division is a multi-step process. Accuracy and fairness are paramount to ensure a just outcome for both spouses.

- Identify and Assess all Business Assets and Liabilities: This includes tangible assets (equipment, inventory), intangible assets (intellectual property, goodwill), and all outstanding debts and liabilities.

- Review all Relevant Contracts: Thoroughly examine all business contracts to determine their impact on the business’s value and future prospects. This might require expert testimony from business valuators or accountants.

- Determine Fair Market Value: Employ qualified professionals to conduct a formal business valuation. This valuation should consider the business’s financial statements, market conditions, and the impact of any contracts.

- Account for Debt and Liabilities: Subtract the business’s debts and liabilities from its fair market value to determine the net asset value.

- Equitable Distribution: Divide the net asset value equally between the spouses, unless there are compelling reasons for a disproportionate distribution. This division might involve a cash payout, transfer of ownership, or a combination of both.

Tim Redaksi